Weekend Strategy Review February 16, 2014

Posted by OMS at February 16th, 2014

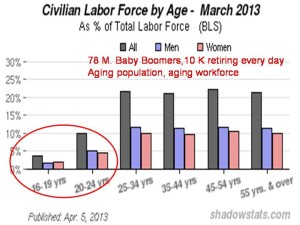

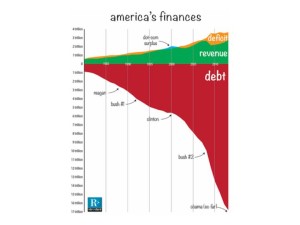

During my Update Class last Thursday night, I talked about the Baby Boomers and the impact they were having on government spending and the economy. Federal entitlement programs represent a large portion of the U.S Federal budget, and when you combine these programs with the interest on the debt, there isn’t much left over to run the country. As a matter of fact, there isn’t anything left over, and that’s why we need to borrow money every month just to keep the government running (and pay for things like Social Security, Medicare and Medicaid).

So during the Class, I polled the 61 students and asked them to raise their hand if they wanted to reduce Social Security. Nobody raised their hand.

Then I asked if anyone was in favor of reducing Medicare. Same thing, nobody raised a hand.

Finally, after talking about the enormous debt that we were creating with all these programs and the problems they were creating for the economy, I asked if anyone was in favor of reducing Medicare. Again, nobody raised their hand. Not one person in the Class was in favor of reducing or stopping any of these entitlement programs.

After the discussion, I showed them a chart (attached) of the current debt and how it has continued to grow over the years. I pointed out how the debt has grown independent of who was president. It grew because the majority of people in America want their entitlements.

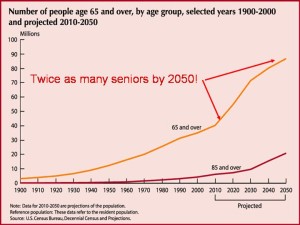

I then showed my students another chart (also attached) that depicts how the number of seniors will continue to grow in the next 25 years, adding to the debt.

After discussing the problems this enormous debt was creating for the economy and the job market, we talked about how the debt could be reduced or paid off.

I asked if anyone was in favor of increasing taxes. Not one hand went up. I asked if anyone would vote for a politician who wanted to raise taxes. Again, not one hand was raised. Hmmm? So it appears that everybody wants to keep receiving the benefits, but really doesn’t want to pay for them.

Because of this, huge Federal deficits and increasing debt will likely continue in the future. So you need to ask yourself about interest rates. Will they be going up or down? You really don’t need Janet Yellen to tell you this. All you need to do is think about the interest payments on the current debt. They MUST stay low, not for the next few months, or years, but for the foreseeable future…and beyond. If interest rates start to rise, and people want to keep their entitlements, the government will have to borrow even more money, requiring even more interest to be paid to foreigners. The debt is so big now; it will likely NEVER be paid off.

So now you can understand why the Fed MUST do everything in its power to keep interest rates low. It’s not a question of stimulating the economy anymore; it’s a matter of survival!

OK, so how do we deal with this? Well, IF we know that interest rates will likely stay low in the future, we should focus on investments that should do well in a low interest environment.

Several come to mind, like utilities and the banks.

Utilities borrow a lot of money to keep their plants running and expand their facilities to meet the needs of a growing population. They are extremely interest rate sensitive.

I haven’t talked about the utes much on these pages, mainly because almost all of the Fed’s stimulus money was going into other sectors driving the Dow Industrials and NASDAQ technology stocks higher. But this could start to change in the months ahead.

As the Dow moves beyond 16,000, investors, especially seniors, are becoming more risk adverse. Most are only in the market now because they are being forced into it by the government’s low interest rate policy. They can’t live on the interest they receive from CDs or Money Market funds.

But now that the overall market is starting to look overbought and the utilities are near their lows, they are becoming more and more attractive.

Near the end of last year, I started to talk about Consolidated Edison, ED, my favorite Christmas stock. The ‘trade’ didn’t work out this year as ED turned negative after a small pop in mid-November. The stock was in a downtrend when we first looked at it, and wasn’t ready to move higher.

But now, a clear TLB pattern has formed and the PT indicators have turned Green once again. I’m ready to give it another shot. So I will be buying a few shares of ED on Tuesday as a ‘trade’. These shares will go into my IRA account. Remember, ED is still in a down trend, so I can’t fall in love with it. But IF the PT indicators stay Green and it ‘Jumps the Ropes’, I’ll start to add additional shares.

Finding stocks to take advantage of the low interest environment will be the focus of my Big Picture Strategy for 2014. And contrary to popular belief, not all stocks will be able to do this. I’ll discuss why in the days ahead, but it mostly has to do with jobs and the economy.

Meanwhile, now that the Dow has moved into the decision zone of 16,100 -16,300, that I talked about last week; I would expect it to take another breather before moving higher. The Professor only had 30 longs and 3 shorts, so he continues his positive bias, but not enough for me to become aggressive and stop scalping. If the market does pull back and forms a small Blade, that’s where I would expect The Professor to become active.

BTW, a subscriber asked me to include an Updated chart of the Dow that shows the Ending Diagonal Pattern. I have attached both a Weekly and Daily chart to show the pattern.

Have a great weekend.

That’s what I’m doing,

h

U.S markets will be closed on Monday in observance of the President’s Day Holiday.

| Market Signals for 02-18-2014 |

|

|---|---|

| DMI (DIA) | POS |

| DMI (QQQ) | POS |

| COACH (DIA) | POS |

| COACH (QQQ) | POS |

| A/D OSC | |

| DEANs LIST | POS |

All of the commentary expressed in this site and any attachments are opinions of the author, subject to change, and provided for educational purposes only. Nothing in this commentary or any attachments should be considered as trading advice. Trading any financial instrument is RISKY and may result in loss of capital including loss of principal. Past performance is not indicative of future results. Always understand the RISK before you trade.

Category: Professor's Comments, Weekend Strategy Review